Inflation and Your Retirement

In the realm of financial planning, especially as it intersects with retirement, inflation is a term that frequently comes up. It's a silent yet potent factor that can significantly influence your retirement funds and overall financial comfort during your golden years. As a seasoned financial advisor with a background in serving our nation, I bring a unique perspective in helping you navigate through these monetary challenges, ensuring a stable and comfortable retirement.

Understanding Inflation

Inflation is the rate at which the general level of prices for goods and services is rising, and subsequently, eroding purchasing power. Essentially, with inflation, each unit of currency buys fewer goods and services. This is a crucial concept because it means that the money saved or invested will have less purchasing power in the future.

Inflation is calculated using the Consumer Price Index (CPI), which measures the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The Bureau of Labor Statistics (BLS) releases CPI data monthly, and it's a reliable measure to track inflation over time.

Impact on Retirement Cash Flow

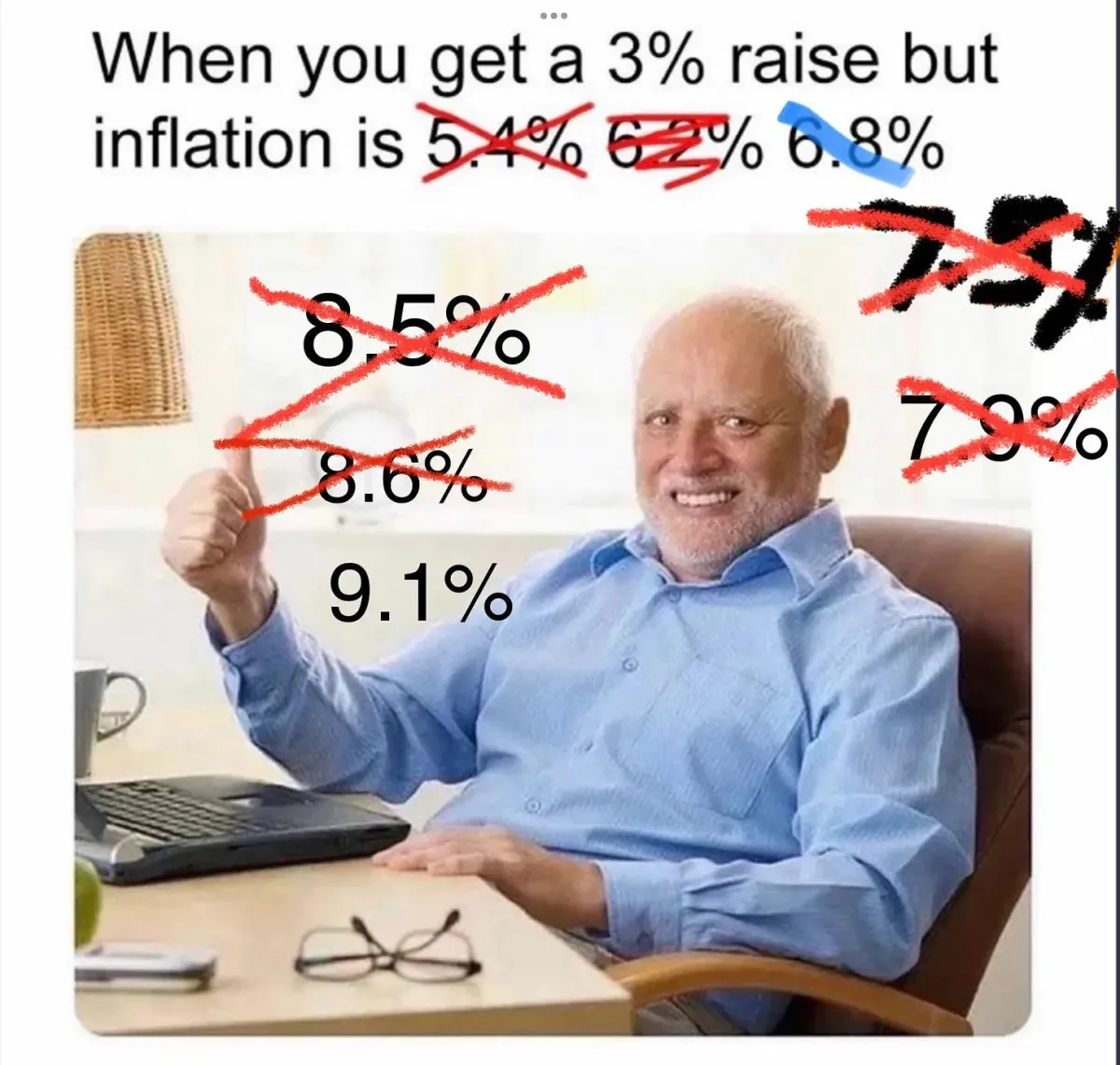

Inflation can significantly affect retirees, especially when it comes to cash flow. The cost of living generally rises over time, which means the purchasing power of a fixed income diminishes. This situation can strain financial resources, particularly if the retiree has not accounted for inflation in their retirement planning.

Medical Costs and Inflation

Medical expenses are a prime example of a cost that can skyrocket due to inflation. Healthcare inflation typically outpaces general inflation, and given that medical care is a significant expense for many retirees, this can pose a substantial financial burden.

Social Security and Inflation

Fortunately, Social Security benefits are adjusted for inflation annually through Cost-Of-Living Adjustments (COLAs). However, these adjustments may not always keep pace with the actual increases in living costs experienced by retirees, especially in high-inflation periods.

Other Challenges

Furthermore, other essential goods and services such as food, housing, and transportation are subject to inflation, which could lead to a higher cost of living than anticipated. Moreover, the impact of inflation can be even more pronounced for those with longer life expectancies, as the cumulative effect of inflation can significantly erode purchasing power over time.

Mitigating Inflation's Impact

A well-thought-out financial plan can help mitigate the effects of inflation. Strategies might include diversified investment portfolios that seek to outpace inflation, Treasury Inflation-Protected Securities (TIPS), and other inflation-hedging options. It's essential to work with a knowledgeable financial advisor to understand how inflation can impact your retirement and devise a plan to protect your purchasing power and ensure a comfortable retirement.

As your committed financial advisor, my mission is to empower you with the knowledge and strategies necessary to mitigate inflation's impact on your retirement. By comprehensively understanding and planning for inflation, you can preserve your purchasing power, ensuring a comfortable and fulfilling retirement.

©2023 Lewis Wealth Management Group. All rights reserved.

Lewis Wealth Management Group

217-337-5584

2506 Galen Drive Ste 104

Champaign IL 61821

Check the background of your financial professional on FINRA's BrokerCheck.