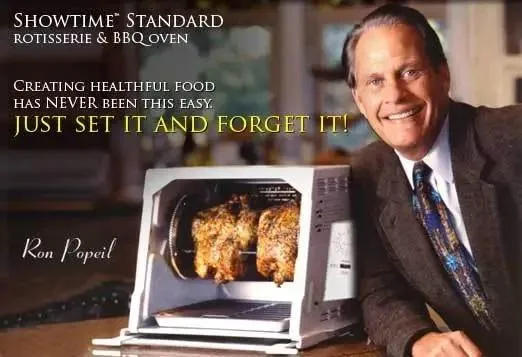

Don't Just Set It and Forget It

Let's face it, folks – managing money isn't always as thrilling as spending it. But when it comes to your 401(k), adopting a "set it and forget it" attitude might just leave your retirement dreams on the back burner. The importance of checking in on your 401(k) from time to time cannot be overstated. It's like nurturing a plant; it needs attention, sunlight, and a bit of love to flourish. Otherwise, you might just find it's been in the shade too long, stunting its growth. So, buckle up! We're about to dive into why your 401(k) deserves more than just a glance every blue moon.

Why Your 401(k) Needs a Regular Check-up

Market Fluctuations: Like a boat in the open sea, market conditions can change rapidly. Your initial investment choices might not weather a storm or capitalize on sunny days without regular adjustments.

Changing Life Circumstances: As your life evolves, so should your retirement plan. Marriage, buying a house, or a change in career path can significantly impact your retirement goals and risk tolerance.

Fees, Fees, Fees: Not all investments are created equal, especially when it comes to fees. Regularly checking can help you weed out high-cost funds that eat into your returns.

The Pitfalls of "Set It and Forget It"

Missed Opportunities: By not reviewing your account, you might miss out on reallocating your investments to take advantage of market trends or more favorable options.

Overexposure to Company Stock: A common hiccup! If your company's stock becomes a Godzilla-sized portion of your portfolio, it's time to rebalance. After all, diversity is the spice of life—and investing.

How Often Should You Peek at Your 401(k)?

Here's the golden question: How often is often enough? While there's no one-size-fits-all answer, a good rule of thumb is to check in at least quarterly. This doesn't mean you should make changes each time; it's more about staying informed and making adjustments as needed.

The Importance of Checking In on Your 401(k) from Time to Time

Know What You Own

It's shocking how many people couldn't tell you what they're invested in. Understanding the assets within your 401(k) is crucial for ensuring they align with your retirement goals and risk tolerance.

Rebalance Like a Pro

Market movements can throw your initial investment allocations out of whack. Regular check-ins allow you to rebalance your portfolio, ensuring it remains in line with your desired asset allocation.

FAQs

Q: What if I'm not confident in making investment decisions?

A: Fear not! Consider consulting with a financial advisor. They can provide tailored advice and help you navigate the sometimes choppy waters of investment choices.

Q: Can I really make a big difference by checking my 401(k) regularly?

A: Absolutely! Small tweaks over time can lead to significant improvements in your investment outcomes. Think of it as steering your ship with a steady hand, making sure you're always heading towards your retirement goals.

Now, let's get real. Your 401k isn't just another item on your to-do list; it's the cornerstone of your future financial security. Ignoring it could mean missing out on opportunities to grow your nest egg or inadvertently taking on too much risk. That's why it's crucial to shake off the "set it and forget it" mentality and give your 401k the attention it deserves.

Don't leave your retirement to chance. It's time to take control and ensure your 401k is working as hard as you are toward your dream retirement. Whether you're a seasoned investor or new to the game, there's always something to learn or adjust. If all this talk about investments, diversification, and fees feels overwhelming, you're not alone. But here's the good news: help is just a phone call away.

Ready to get serious about your retirement planning? Schedule a phone call with us today to learn more about optimizing your 401k. Our team of experts is here to guide you through the complexities of retirement planning, ensuring you have the knowledge and tools to make informed decisions about your future. Don't wait until it's too late to start asking the right questions and making the right moves. Your future self will thank you.

Remember, checking in on your 401k from time to time isn't just a good habit; it's a crucial step in securing your financial future. So, what are you waiting for? Reach out now and take the first step toward a retirement that's not just comfortable but downright golden.

©2023 Lewis Wealth Management Group. All rights reserved.

Lewis Wealth Management Group

217-337-5584

2506 Galen Drive Ste 104

Champaign IL 61821

Check the background of your financial professional on FINRA's BrokerCheck.